How Do Forex Volatility and Liquidity Affect Businesses?

- 1 Understanding Forex Volatility

- 2 Factors Contributing to Forex Volatility

- 3 How Forex Volatility Affects Businesses

- 4 Understanding Forex Liquidity

- 5 Factors Affecting Forex Liquidity

- 5.1 Market hours

- 5.2 Currency pairs

- 5.3 Market participants

- 5.4 Market conditions

- 6 How Forex Liquidity Affects Businesses

- 6.1 Transaction costs

- 6.2 Market access

- 6.3 Currency Hedging

- 7 Managing Forex Volatility and Liquidity Risks

- 8 Final Worlds

The foreign exchange market is the world’s largest and most liquid financial market, with trillions of dollars traded and processed by liquidity aggregation solutions daily. Businesses that engage in international trade investments or have operations in multiple countries are significantly impacted by fluctuations in currency values. Two key factors that companies must navigate are volatility and liquidity.

We’ll explore what volatility and liquidity mean in the context of Forex, how they influence business decisions, and what companies can do to manage the associated risks.

Understanding Forex Volatility

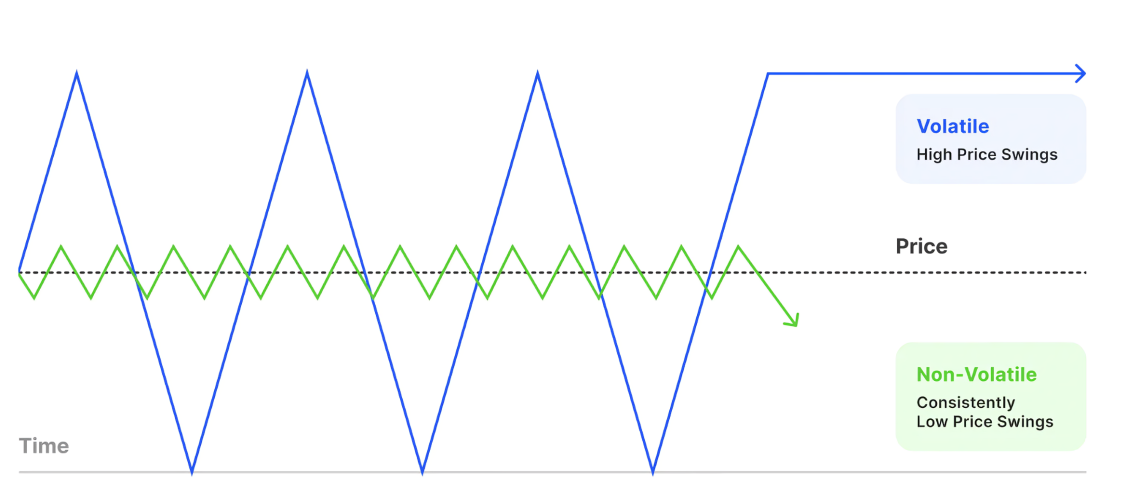

Volatility in the Forex market refers to the rate at which currency prices fluctuate. High volatility means that currency prices experience significant movements, either up or down, quickly. Low volatility, on the other hand, indicates more stable and predictable price movements.

Factors Contributing to Forex Volatility

Economic data releases

Reports on GDP growth, employment numbers, inflation, and interest rates can trigger significant currency movements. For example, a stronger-than-expected employment report in the United States might lead to an appreciation of the U.S. dollar.

Geopolitical events

Political instability, trade wars, elections, and other geopolitical factors can lead to market uncertainty. Currency prices react quickly to changes in the global political landscape.

Central bank policies

Decisions made by central banks, such as interest rate hikes or monetary policy changes, can cause currency prices to fluctuate. For instance, when a central bank raises interest rates, its currency tends to appreciate due to higher returns on investments denominated in that currency.

Market sentiment

Investor sentiment, driven by risk appetite or aversion factors, can affect currency volatility. For example, investors may flock to safe-haven currencies like the Swiss franc or the Japanese yen during global economic uncertainty, causing other currencies to lose value.

How Forex Volatility Affects Businesses

Businesses that operate internationally or have exposure to foreign currencies are directly impacted by Forex volatility. The fluctuations in currency values can affect several aspects of their operations, including:

Profit margins

A sudden increase or decrease in exchange rates can significantly impact the profit margins of businesses engaged in cross-border transactions. For instance, if a company in the U.S. is importing goods from Europe and the euro strengthens against the U.S. dollar, the company will need to pay more dollars for the same amount of euros, eroding its profit margins.

Pricing strategy

Forex volatility can also affect pricing strategies for companies that export goods or services. A company may need to adjust its prices based on fluctuations in the exchange rate to maintain profitability or remain competitive in foreign markets.

Cash flow management

Currency fluctuations can lead to unpredictable business cash flows, challenging the planning of expenses, payroll, and other financial obligations. A company receiving payments in foreign currencies may face difficulties if the value of those currencies declines before the funds are converted into their local currency.

Investment decisions

Volatility can also influence investment decisions. Businesses may hesitate to invest in countries with volatile currencies, fearing that currency fluctuations could negatively impact their returns.

Understanding Forex Liquidity

Liquidity in the Forex market refers to the ease with which a currency can be bought or sold without causing significant price movements. Large volumes of currency can be traded in highly liquid markets without substantially affecting prices. In contrast, low liquidity markets experience more significant price swings due to even small trades.

Factors Affecting Forex Liquidity

Market hours

Liquidity is generally higher during overlapping trading sessions. For instance, when the New York and London sessions overlap, the Forex market experiences higher trading volumes and, consequently, higher liquidity.

Currency pairs

Major currency pairs (e.g., EUR/USD, GBP/USD) are more liquid than minor or exotic pairs (e.g., USD/TRY, EUR/HUF). The higher trading volume in significant currency pairs means they are more liquid and less prone to large price swings.

Market participants

Institutional players such as banks, hedge funds, and multinational corporations contribute to higher liquidity in the Forex market. The participation of these players in trading increases the depth of the market and helps to stabilize prices.

Market conditions

During economic uncertainty or geopolitical instability, liquidity can dry up as traders become more risk-averse. This can lead to wider bid-ask spreads and greater volatility.

How Forex Liquidity Affects Businesses

Liquidity, or the lack of it, in the Forex market, can also have a significant impact on businesses:

Transaction costs

Businesses benefit from tighter bid-ask spreads in a highly liquid market, meaning they can execute trades at better prices. However, wider spreads can increase transaction costs in low-liquidity markets, eroding profitability.

Market access

In highly liquid markets, businesses can easily convert foreign currency holdings into local currency or hedge their currency exposure. In low-liquidity markets, finding counterparties to trade with may be more complex, and businesses may be forced to accept less favorable rates.

Currency Hedging

Liquidity is crucial for businesses that use hedging strategies to protect against currency risk. A liquid market allows firms to enter and exit hedging positions quickly and at competitive prices. In illiquid markets, however, the cost of hedging can be higher, and implementing effective risk management strategies may be more challenging.

Managing Forex Volatility and Liquidity Risks

Given the significant impact that Forex volatility and liquidity can have on businesses, companies must implement strategies to manage these risks. Here are some common approaches:

1. One of the most effective ways to manage Forex volatility is through currency hedging. Hedging involves entering into financial contracts (e.g., forward contracts, options) that protect against unfavorable currency movements. Businesses can stabilize their cash flows and protect profit margins by locking in exchange rates or limiting downside risk.

2. Diversifying suppliers, markets, and currencies can help businesses mitigate the risks associated with currency volatility. By spreading operations across multiple countries and currencies, a company can reduce its exposure to any single currency’s fluctuations.

3. Natural hedging involves structuring a business’s operations to reduce currency exposure without the need for financial instruments. For example, a company with U.S. and European operations might denominate its revenues and expenses in the same currency, minimizing the impact of exchange rate movements.

4. Monitoring and analysis of market conditions and economic indicators can help businesses anticipate potential volatility and liquidity issues. By using Forex analytics tools, forex trading robot and consulting with financial experts, companies can make informed decisions and adjust their strategies to minimize risk.

Final Worlds

Forex volatility and liquidity are two critical factors that can significantly impact businesses engaged in international trade or exposed to foreign currencies. While volatility can lead to unpredictable changes in profit margins, pricing strategies, and cash flow, liquidity affects transaction costs and the ease businesses can manage their currency exposure.